The Nifty50 continued to see formation of Doji pattern for yet another session, indicating indecisiveness among bulls and bears about the future market trend, but the index continued higher highs and higher lows formation for the fifth consecutive session on November 8. Hence, will the Nifty50 march towards 19,550-19,600 levels?

The Nifty50 is required to decisively break 19,450, the critical resistance which coincides with the 50-day EMA (exponential moving average) for further upmove towards 19,550-19,600, but in case it breaches 19,400, then the correction can be possible up to 19,300-19,250, the current support area, experts said.

On November 8, the BSE Sensex gained 33 points at 64,976, while the Nifty50 rose 37 points to 19,444 and formed a small body candle on the daily chart with minor upper and lower shadow.

“This market action indicates the formation of a Doji-type candle pattern, which is back-to-back for two sessions. This signals a confused state of mind among market participants,” Nagaraj Shetti, technical research analyst at HDFC Securities said.

The opening upside gap of November 2, November 3 and November 6 remains intact on the daily chart and the immediate resistance of 19,300 has already been broken on the higher side.

“The overall chart pattern remains positive and one may expect Nifty to advance towards 19,600 levels in the short term. Any dips from here could be a buying opportunity around 19,300-19,250 levels,” he said.

The Nifty Midcap 100 and Smallcap 100 indices continued to perform better than benchmarks, rising 1 percent and 0.7 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may take support at 19,412, followed by 19,398 and 19,374. On the higher side, 19,460 can be the immediate resistance followed by 19,475 and 19,499.

Nifty Bank

On November 8, the Bank Nifty snapped a four-day run and fell 79 points to 43,659 after consolidation, forming a bearish candlestick pattern with a lower shadow on the daily scale, but held a 21-day EMA for the third straight session.

“The overall pullback has faced resistance in the zone 43,650 – 43,800. However, we expect this consolidation to ultimately break on the upside and stretch higher till 44,000 from a short-term perspective,” Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

As per the pivot point calculator, the index is expected to take support at 43,573, followed by 43,514 and 43,418. On the upside, the initial resistance is at 43,763 then at 43,822 and 43,918.

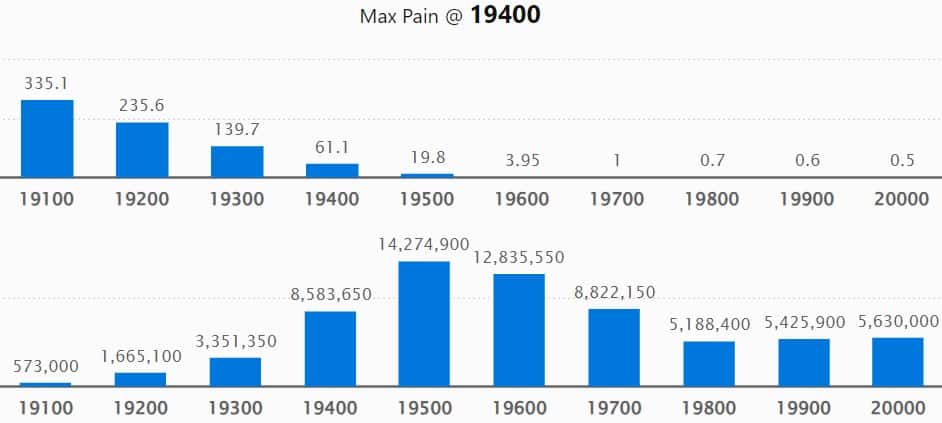

Call options data

As per the weekly options data, the maximum Call open interest (OI) remained at 19,500 strike, with 1.42 crore contracts, which can act as a key resistance for the Nifty. It was followed by the 19,600 strike, which had 1.28 crore contracts, while the 19,700 strike had 88.22 lakh contracts.

The maximum Call writing was seen at 19,500 strike, which added 61.66 lakh contracts followed by 19,600 and 19,700 strikes, which added 55.36 lakh and 31.44 lakh contracts.

Maximum Call unwinding was at 19,300 strike, which shed 5.52 lakh contracts followed by 19,100 and 19,000 strikes, which shed 2.34 lakh and 1.33 lakh contracts.

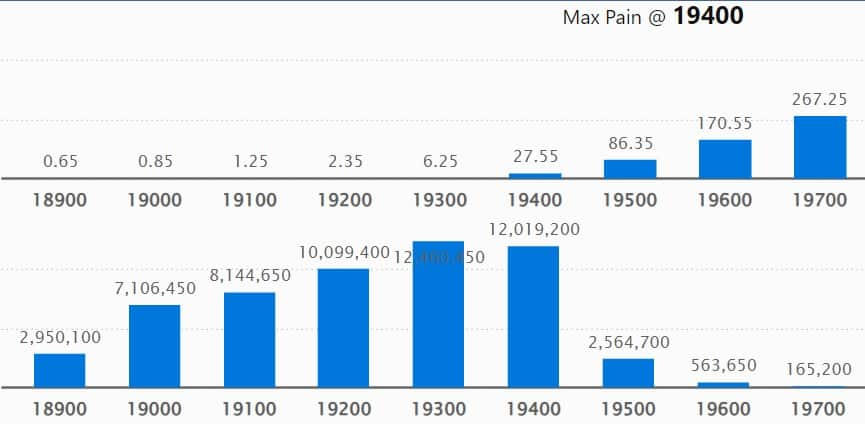

Put option data

On the Put side, the maximum open interest also remained at 19,300 strike with 1.25 crore contracts, which can act as key support for the Nifty. It was followed by 19,400 strike comprising 1.2 crore contracts and 19,200 strike with 1 crore contracts.

Meaningful Put writing was at 19,400 strike, which added 54.43 lakh contracts followed by 19,300 strike and 19,100 strike, which added 47.32 lakh and 32.75 lakh contracts.

Put unwinding was at 18,700 strike, which shed 5.43 lakh contracts followed by 18,600 strike and 18,400 strike which shed 2.06 lakh and 1.96 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Mphasis, Marico, Havells India, ITC, and Britannia Industries saw the highest delivery among the F&O stocks.

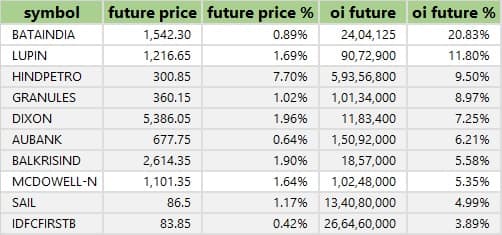

59 stocks see a long build-up

A long build-up was seen in 59 stocks, including Bata India, Lupin, Hindustan Petroleum Corporation, Granules India, and Dixon Technologies. An increase in open interest (OI) and price indicates a build-up of long positions.

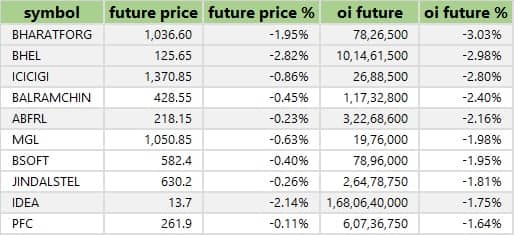

25 stocks see long unwinding

Based on the OI percentage, 25 stocks saw long unwinding including Bharat Forge, BHEL, ICICI Lombard General Insurance Company, Balrampur Chini Mills, and Aditya Birla Fashion & Retail. A decline in OI and price indicates long unwinding.

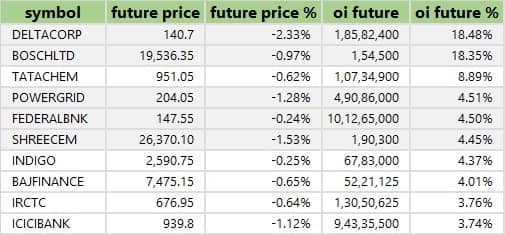

45 stocks see a short build-up

A short build-up was seen in 45 stocks, including Delta Corp, Bosch, Tata Chemicals, Power Grid Corporation of India, and Federal Bank. An increase in OI along with a fall in price points to a build-up of short positions.

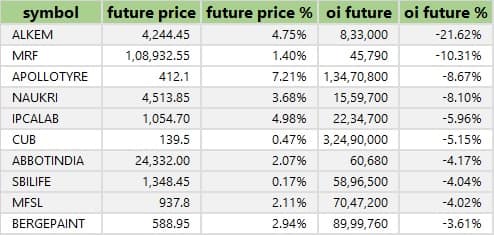

58 stocks see short-covering

Based on the OI percentage, 45 stocks were on the short-covering list. These include Alkem Laboratories, MRF, Apollo Tyres, Info Edge India, and Ipca Laboratories. A decrease in OI along with a price increase is an indication of short-covering.

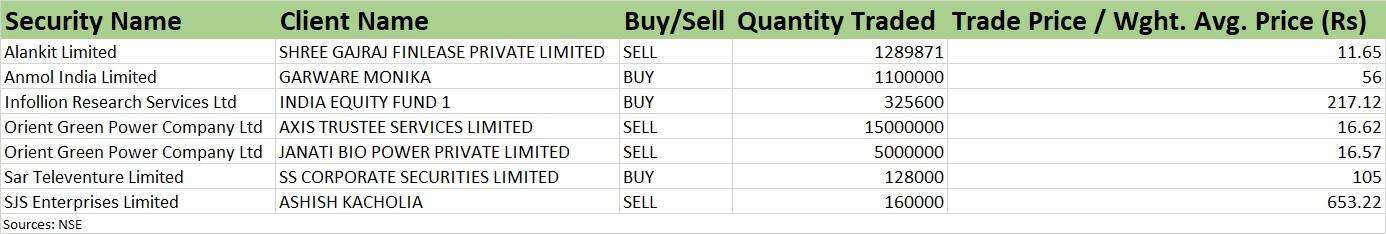

Bulk deals

SJS Enterprises: Ace investor Ashish Kacholia has sold 1.6 lakh equity shares or 0.51 percent stake in the aesthetics products manufacturing company, via open market transaction, at an average price of Rs 653.22 per share, amounting to over Rs 10 crore.

Results on November 9

Adani Ports and Special Economic Zone, Aurobindo Pharma, Bosch, ABB India, Zee Entertainment Enterprises, Aditya Birla Fashion and Retail, Apollo Hospitals Enterprise, Ashok Leyland, Bajaj Consumer Care, Engineers India, GlaxoSmithKline Pharmaceuticals, IRM Energy, Lemon Tree Hotels, Samvardhana Motherson International, Muthoot Finance, NALCO, Page Industries, Rail Vikas Nigam, Sula Vineyards, and Torrent Power will release quarterly earnings scorecard on November 9.

Stocks in the news

Biocon: Subsidiary Biocon Biologics has entered into a definitive agreement with Eris Lifesciences for the divesture of its dermatology and nephrology branded formulations business units in India, on a slump sale basis. The total transaction value of the divestment is Rs 366 crore.

Tata Power Company: The Tata Group company has reported an 8.8 percent on-year increase in consolidated net profit at Rs 1,017.4 crore for quarter ended September FY24, partly driven by other income and lower tax cost. Revenue from operations stood at Rs 15,738 crore for the quarter, increasing 12.2 percent over a year-ago period, largely driven by higher revenue from core businesses of generation, transmission & distribution.

Mazagon Dock Shipbuilders: The state-owned shipbuilding company has registered a massive 55.6 percent on-year growth in consolidated profit at Rs 333 crore for July-September period of FY24, driven by other income and strong operating numbers. Consolidated revenue from operations increased by 7.4 percent to Rs 1,827.7 crore compared to the year-ago period.

Pidilite Industries: The adhesives, sealants and construction chemicals manufacturing company has reported a 36 percent on-year growth in consolidated profit at Rs 458.5 crore for the quarter ended September FY24, driven by healthy operating numbers post fall in input cost. Revenue from operations increased by 2.2 percent YoY to Rs 3,076 crore for the quarter with domestic consumer volume growth at 8 percent.

United Spirits: The alcoholic beverages company has registered a 37 percent on-year decline in standalone profit at Rs 341.3 crore for the July-September period of FY24 as the base was high due to exceptional gain. Standalone revenue from operations fell 1.4 percent YoY to Rs 2,864.7 crore for the quarter.

Oil India: The state-owned oil & gas exploration company has reported an 81 percent year-on-year decline in standalone profit at Rs 325.3 crore for the quarter ended September FY24, impacted by the exceptional loss. Revenue from operations grew by 15.1 percent year-on-year to Rs 5,342.4 crore.

Bata India: The footwear company has recorded a 38 percent on-year decline in consolidated profit at Rs 34 crore for July-September period of FY24, impacted by expenses towards VRS, but operating numbers were strong. Revenue from operations declined 1.3 percent to Rs 819 crore compared to the corresponding period last fiscal.

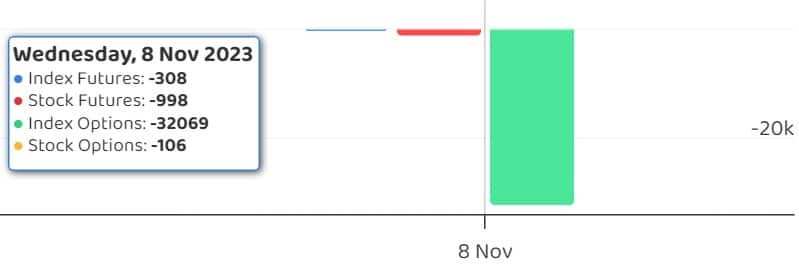

Fund Flow (Rs Crore)

FII and DII data

Foreign institutional investors offloaded shares worth Rs 84.55 crore, while domestic institutional investors bought Rs 524.47 crore worth of stocks on November 8, provisional data from the National Stock Exchange showed.

Stock under F&O ban on NSE

The NSE has added Delta Corp to its F&O ban list for November 9, while retaining GNFC (Gujarat Narmada Valley Fertilizers and Chemicals) in the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.