The National Stock Exchange’s Nifty closed the September F&O (futures and options) series with a gain of 1.4 percent despite a late meltdown. But the rollover of shorts to October and the unwinding of long positions by foreign institutional investors or FIIs may make the ride bumpy for the index in the ongoing October series.

The Nifty hit fresh record highs in the first half of September, scaling 20,000 points for the first time ever. The month also marked the fifth positive F&O expiry in the last six series. However, the double whammy of shorts rollover and FIIs’ falling long positions highlights the cracks emerging in the market’s resilience.

Further, key events including the Reserve Bank of India’s monetary policy meeting, the MSCI rejig and July-September earnings will keep investors on a cautious footing.

The previous F&O series was the second in a row to be marked by liquidation of long positions, whereas the October series was filled with rollover of short positions.

FIIs unwind long, hedge positions; short rollovers surge

A report by Religare Broking highlighted the decline in long positions taken by FIIs as it dropped to 30 percent of their total positions in Nifty futures, down from 50 percent seen at the start of the September F&O series. The broking firm sees this trend as a sign of increased hedging by FIIs.

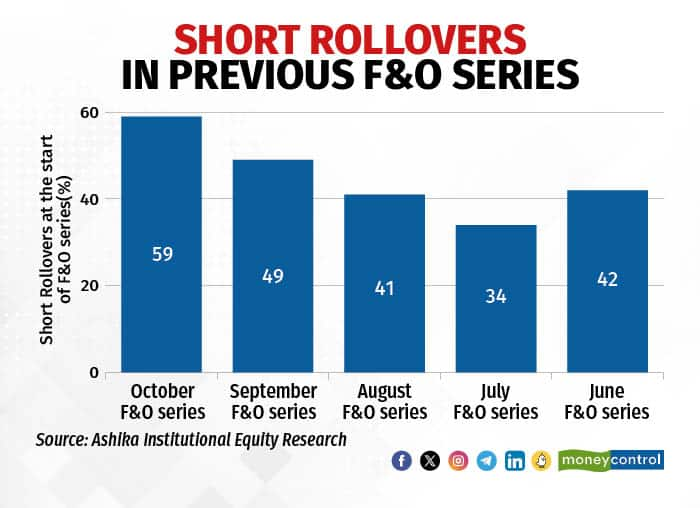

On the other hand, rollovers for FIIs on a net basis stood at 57,279 (net short) contracts against 1,694 (net long) contracts in the previous series, Ashika Stock Broking noted in its report. “Along with that, their short positions at the start of the new series also increased to 59 percent as compared to 49 percent in the September F&O series, mainly on the back of higher long unwinding and short addition,” highlighted Viraj Vyas, technical and derivative analyst at Ashika Stock Broking.

How rollover positions stack up for Nifty October series

Meanwhile, the net long positions of domestic institutional investors (DIIs) also declined to 41 percent, down from 51 percent at the start of the previous series as they booked profits during the September series.

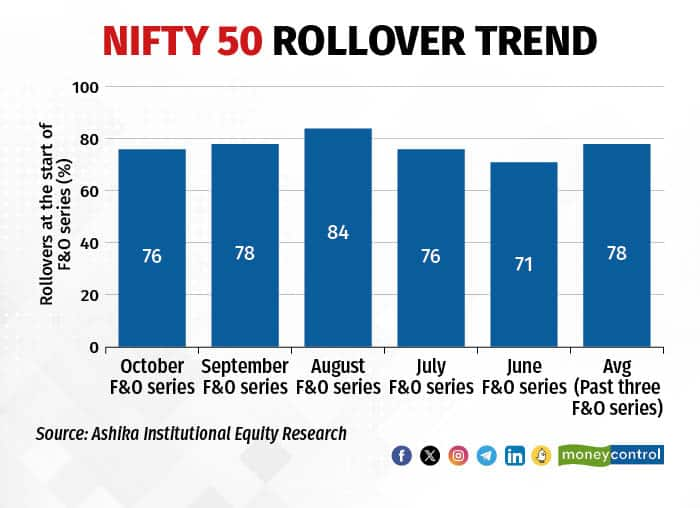

According to Ashika Stock Broking, rollovers of Nifty’s October futures stood at 76 percent, lower than the average of 78 percent seen at the start of the past three series.

Market-wide rollovers were at 91 percent, in line with the three-month average of 91 percent and rollovers of stock futures.

Excessive volatility to persist for Nifty; Blue-chips to remain range bound

The Nifty and the broader market owe much of their momentum and ascent to fresh all-time highs to the active support from FIIs and DIIs. However, their wavering enthusiasm may spoil the party for the Nifty, especially as the market enters into the quarterly earnings season.

Based on the rollover data, Abhilash Pagaria of Nuvama Alternative & Quantitative Research foresees a broader trading range for heavyweight stocks, with significant resistance for the Nifty looming at the 19,900 mark. Moreover, he also warned that any adverse developments could also potentially push the Nifty index down towards the 18,800 level in the short term.

Analysts at Religare Broking share a similar view as they see 19,800 as a pivotal mark for the October F&O series. “Till the time the Nifty trades below 19,800, the index might be on a ‘sell on rise’ mode. We expect the Nifty to find strong support at 19,300-19,350 levels for the October series,” the analysts stated in a report.

Caution is also advised within the broader market as the Nifty Midcap and Small-cap indices outshone the large-cap peers in September and surged to fresh record highs.

“As the midcap and small-cap segments reach unprecedented heights, a sense of caution naturally beckons within the market. This juncture seems to portend volatility, and the upcoming expiry might well usher in a period of fluctuation marked by limited upside,” Pagaria said.

How will industry sectors fare?

According to Ashika Stock Broking, sectors like pharma, automobiles, metals, infra, power, banks and telecom are likely to fare well in the October series as rollovers for these sectors hint towards bullish signs of a long buildup or short covering.

On the flipside, pressure can be seen in fertilisers and chemical stocks, as profit booking may seep into these counters following their stellar run in the past two months. On that account, most stocks belonging to these sectors saw bearish signs of a short buildup or long liquidation.

Nuvama also sees promising opportunities arising from candidates with a potential for inclusion in the MSCI index during its November rejig. These include Polycab, Tata Communications, Punjab National Bank, Persistent Systems, APL Apollo Tubes, One97 Communications, Macrotech Developers and Tata Motors.