One of the most important skill that you need as a trader is the ability to read the market structure, it is a critical skill that will allow you to use the right price action strategies in the right market condition.

You are not going to trade all the markets the same way; you need to study how the markets move, and how traders behave in the market.

The market structure is the study of the market behavior.

And if you can master this skill, when you open your chart, you will be able to answer these important questions:

What the crowds are doing? Who is in control of the market buyers or sellers? What is the right time and place to enter or to exit the market and when you need to stay away?

Through your price action analysis, you will experience three types of markets, trending markets, ranging markets, and choppy markets.

In this chapter, you will learn how to identify every market, and how to trade it.

1-Trending markets

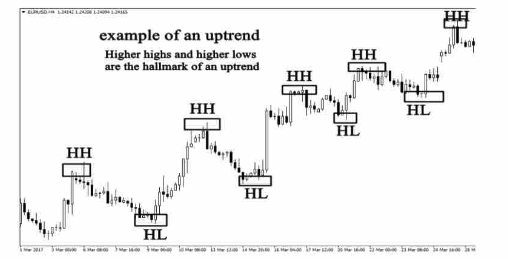

Trending markets are simply characterized by a repeating pattern of higher highs and higher low in an up-trending market, and lower high and lower low in a down trending market.

See the example below:

As you can see in the example above, the market is making series of higher highs and higher lows which indicates that the market is up trending.

You don’t need indicators to decide if it is bullish or bearish just a visual observation of price action is quite enough to get an idea about the market trend.

Look another example of a downtrend market.

The example above shows a bearish market, as you can see there are series of higher lows and lower low which indicate an obvious downtrend.

Trending markets are easy to identify, don’t try to complicate your analysis, use your brain and see what the market is doing.

If it is doing series of higher highs and higher low, it is simply an uptrend market; conversely, if it is making series of lower highs and lower low, it is obviously a downtrend market.

- According to statistics, trends are estimated to occur 30% of the time, so while they are in motion, you’ve got to know how to take advantage of them.

- To determine whether a market is trending or not, you have to use bigger time frames such the 4H, the daily or the weekly time frame.

Never try to use smaller time frames to determine the market structure.

Greetings! Very useful advice in this particular post! It is the little changes which will make the most important changes. Thanks for sharing!

דירות דיסקרטיות בפתח תקווה Hildegarde Trapani