Now i think that you get some information about Japanese candlesticks, you know the anatomy of each candlestick and the psychology behind its formation, let’ take this exercise to test your knowledge and see if you still remember all of the candlesticks we talked about.

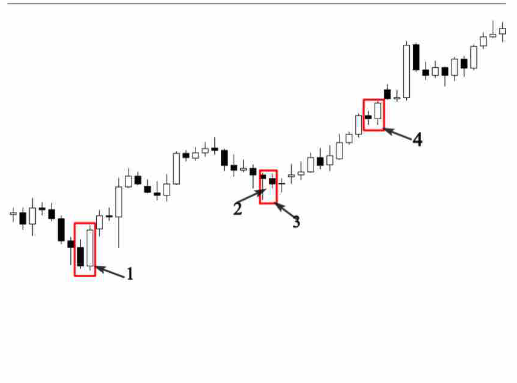

Look at the chart below and try to find the name of each candlestick number, and the psychology behind its formation.

If you can easily identify these candlestick patterns, and you understand why they are formed. You are on the right path.

But if you still struggle to identify these patterns, you will have to start learning about them again till you feel like you master them.

Let’s try to answer the questions concerning the candlestick patterns on the charts above:

1: Bullish Harami pattern (inside bar)

-The formation of this candlestick patterns indicates indecision in the market, in other words, the market was consolidating during this session.

2: Bullish Tweezers

The market was trading up, sellers tried to push the market lower, but the reaction of buyers was more powerful.

This pattern represents the battle between sellers and buyers to take control of the market.

3: Engulfing bar

-Sellers were engulfed by buyers, this indicates that buyers are still willing to push the market higher.

- Engulfing bar

- Engulfing bar

- Engulfing bar

- Harami pattern

This pattern shows us that the market enters in a consolidation phase during this session.so buyers and sellers are in an indecision period.

And no one knows who is going to be in control of the market.

Let’s take another exercise, look at the chart below and try to figure out these candlestick patterns:

Answers:

- Bullish engulfing bar

- Hammer

- (Hammer which is the large body +the smaller body (baby) =Harami pattern

- Bullish engulfing bar

Please, i want you to open your charts, and do this homework over and over again. You will see that with screen time and practice, you will be able to look at your charts, and understand what the candlesticks tell you about the market.

Don’t worry about how to enter and exit the market for the moment, take your time and try to master the candlestick patterns discussed in the previous chapters.

In the next chapters, i will arm you with techniques that will help you identify the best entry and exit points based on candlestick patterns in combination with technical analysis.

Trust me, these price action strategies will turn you from a beginner trader who struggles to make money in the market into a profitable price action trader.

Everything is very open with a really clear description of the challenges. It was definitely informative. Your site is very helpful. Many thanks for sharing!

דירות דיסקרטיות Kendall Palay