Highlights

- Strong double-digit volume growth

- Rural demand outperforms urban demand

- Continued fall in VAM prices aided margin expansion

- Labor unavailability, heatwave, and elections to hamper Q1 performance

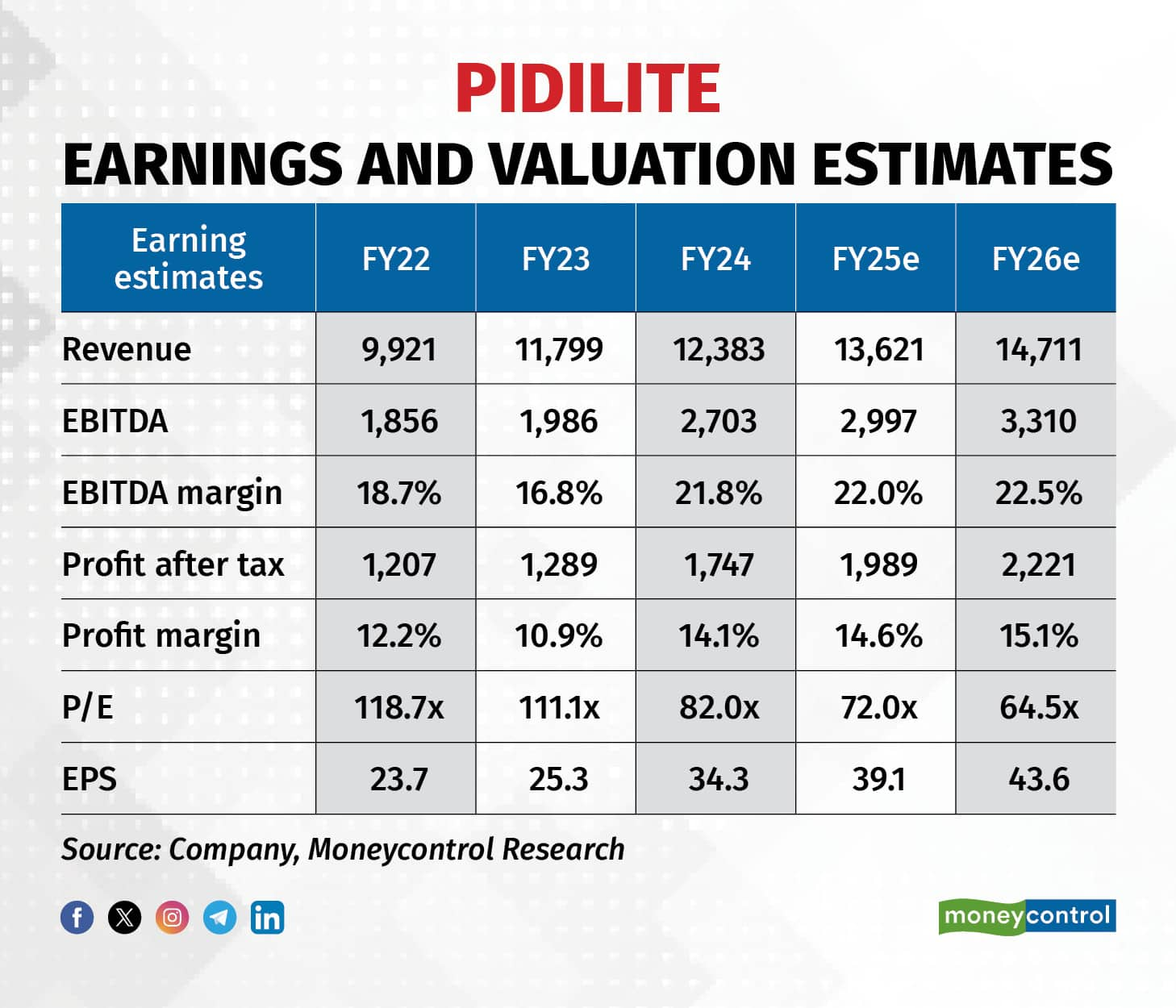

- Stock trades at 65 times FY26 earnings

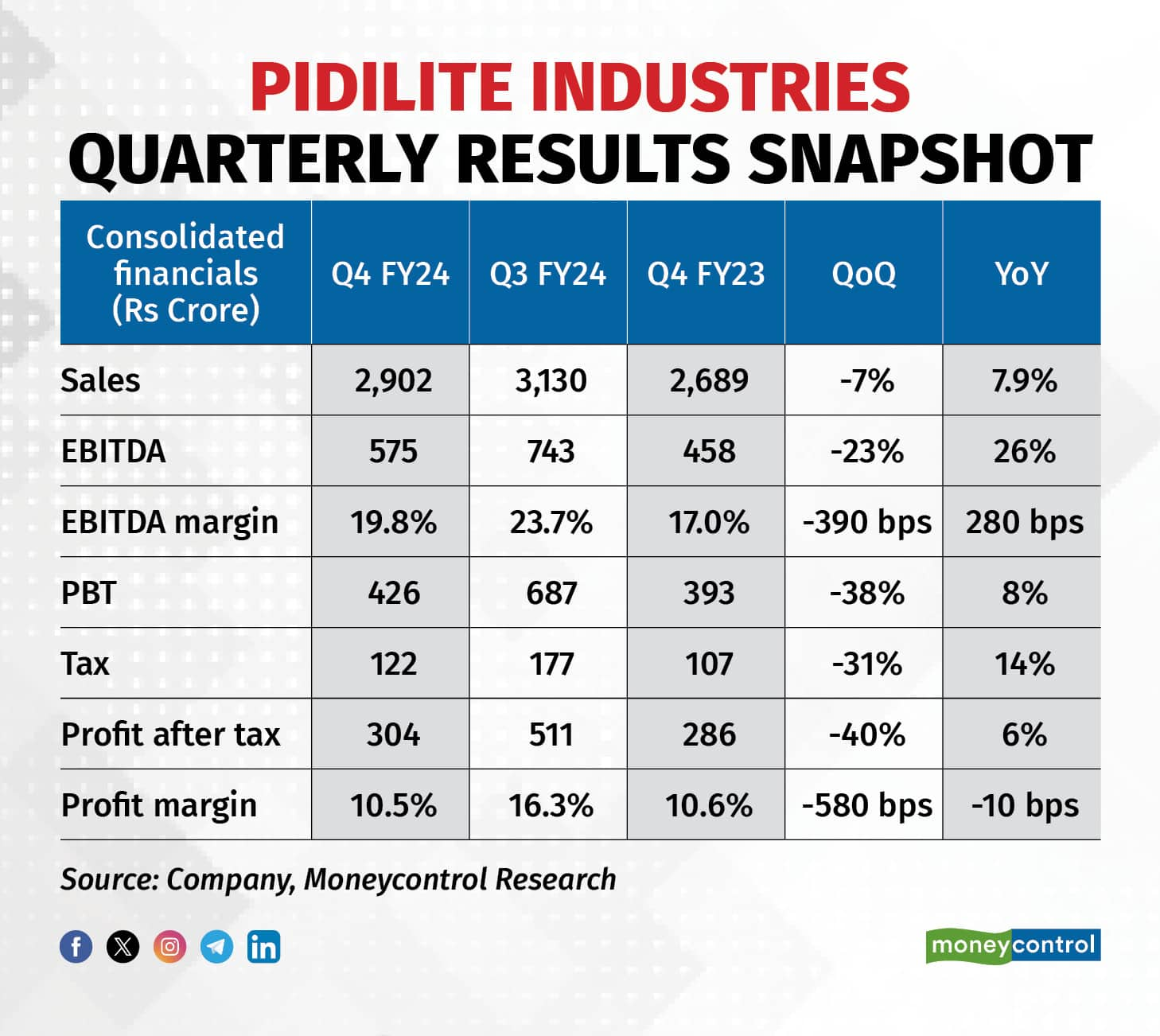

Pidilite Industries (CMP: 2,817; Market cap: Rs 143,235 crores; Rating: Equal weight), a leading manufacturer of adhesives, sealants, and construction chemicals, reported a volume growth of over 15 percent year on year (YoY) across various categories and geographies in the quarter ended March 2024. While operating margins also improved YoY, the profit after tax declined due to a one-time loss of Rs 72 crore related to the divestment of the Brazil subsidiary.

Sustained double-digit volume growthThe largest segment of Pidilite, Consumer and Bazaar (C&B), which accounts for nearly 80 percent of its top line, posted a revenue growth of ~5 percent, whereas the revenues of the Business to Business (B2B) segment grew at a faster clip of ~12 percent. The volume growth for both C&B and B2B businesses was superior, at 13 percent and 25 percent, respectively, due to buoyant demand conditions, expanded distribution, and digital initiatives. However, downward price revisions undertaken to pass on favourable material costs turned out to be a drag on realisations as well as revenues. Given the stability in material prices, the management expects the volume-value gap to narrow from Q2 onwards.

On a regional basis, rural consumption outpaced urban markets throughout the year. Institutional demand for waterproofing continued to be strong, mainly attributed to high infrastructure spending and low penetration levels in the country. Key growth product categories — tile adhesives, floor coatings, and wood finishes — also gained further market traction.More importantly, green shoots are beginning to emerge, which could drive rebound from Q2 onwards.

The company has focused on strengthening the supply chain by expanding capacities at the existing plants and commissioned 10 new plants in FY24. The core products (Fevicol, M-Seal etc.) are expected to grow at 1-1.5 times GDP, while the growth products (Dr Fixit, Araldite, Roff etc.) are anticipated to grow faster at 2-2.5 times GDP on account of category creation, international expansion, and deeper market penetration. Since FY20, the revenue share of growth products has gone up from 35 percent to 45 percent.

VAM prices remain favourable

The Q4 operating margins expanded 280 basis points (bps) to 19.8 percent, despite a jump in advertising expenses (3.8 percent of revenues in Q4) and various consumer-facing initiatives. This was mainly aided by benign raw material prices. The consumption rate of Vinyl Acetate Monomer (VAM), the key raw material for adhesives, stood at $925 per tonne in Q4 compared to $1300 per tonne in the year-ago period. According to the management, VAM prices have most likely bottomed out and are expected to remain stable for the next 6 months.Going forward, advertising expenses are expected to be in the range of 4-4.5 percent of revenues, whereas the operating margins for FY25 are expected to sustain around the current level.

New business forays

Pidilite has acquired Pargro Investments for Rs 10 crore in Q2FY24, marking its entry into the lending business to address credit demand within its ecosystem. The company is getting the necessary licence and regulatory approvals in place and expects to commence operations in the next 2-3 quarters. With a planned investment of nearly Rs 100 crore (spread over the next two years), the lending business aims to support the growth of contractors and dealers.In Q1 FY24, Pidilite entered the interior decorative paints segment with the launch of Haisha Paints (Interior emulsion, Wall primer, and Floor coats). Pidilite is leveraging its distribution network in select states (Andhra Pradesh, Telangana, and Odisha) to capture the decorative paints market in tier 3/4/5 towns. Although the business is still at a nascent stage, Haisha has seen significant improvement in volume growth and profitability in the last 12 months.

Outlook & Valuations

The Pidilite’s stock trades at rich valuations of 65 times FY26 estimated earnings. According to our assessment, the current valuation caps the stock upside from a near-to-medium term perspective.