Ranging markets are pretty straight forward, they are often called sideways markets, because their neutral nature makes them appear to drift to the right, horizontally.

When the market makes a series of higher highs and higher lows, we can say that the market is trending up.

But when it stops making these consecutive peaks, we say that the market is ranging.

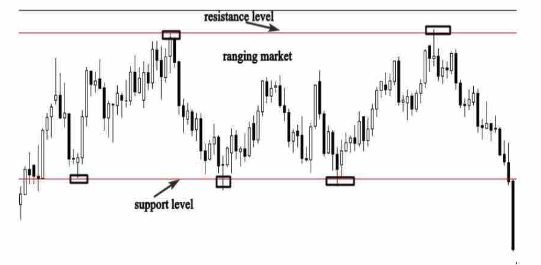

A ranging market moves in a horizontal form, where buyers and sellers just keep knocking price back and forth between the support and the resistance level.

See the example below:

The chart above shows a ranging market, as you can see, the price is bouncing between horizontal support and resistance level.

The difference between trending markets and ranging markets is that trending markets tend to move by forming a pattern of higher high and higher lows in case of an uptrend, and higher low and lower low in case of a downtrend.

But ranging markets tend to move horizontally between key support and resistance levels.

Your understanding of the difference between the both markets will help you better use the right price action strategies in the right market conditions.

Trading ranging markets is completely different from trading trending markets, because when the market is ranging, it creates equilibrium, buyers are equal to sellers, and there is no one in control.

This will generally continue until the range structures broke out, and a trending condition start to organize.

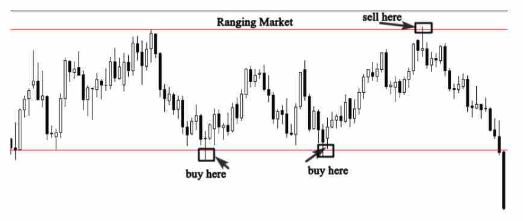

The best buying and selling opportunities occur at key support and resistance levels.

There are three ways to trade ranging markets, i’m not going to go into details, because what i want you to get here is the skill to look at your charts and decide whether the market is trending or ranging.

In the next chapters i will go into details and i will give the trading tactics and strategies that you will use to trade trending or ranging markets.

If you can’t differentiate between ranging markets and trending markets, you will not know how to use these price action strategies.

The first way to trade ranging markets is by waiting for price to approach support or resistance level then you can buy at key support level and sell at key resistance level.

See the example below:

As you can see, the market is moving horizontally, in this case the best buying opportunities occur at the support level.

And the best selling opportunities occur at the resistance level.

The second way of trading ranging markets is by waiting for the breakout from either the support level or the resistance level.

When the market is ranging, no one knows what is going to happen, we don’t know who is going to be in control of the market, this is why you have to pay attention to the boundaries, but when one of the players decide to take control of the market, we will see a breakout of the support or the resistance level.

The breakout means that the ranging period is over, and the beginning of a new trend will take place…

See the example below:

As you can see the market was trading between support and resistance levels, and suddenly the price broke out of the resistance level, this indicates that the beginning of a trend is likely to happen.

So the best way to enter is after the breakout.

It’s important to remember that range boundaries are often overshot, giving the illusion a breakout is occurring, this can be very deceptive, and it does trap a lot of traders who positioned into the breakout.

The third way to trade ranging markets is to wait for a pullback after the breakout of the support or the resistance level.

The pullback is another chance to join the trend for traders who didn’t enter in the breakout.

See the example below:

As you can see in the chart above, the market was ranging, price breaks out of the resistance level to indicate the end of the ranging period, and the beginning of a new trend.

After the breakout, the market comes back to retest the resistance level that becomes support before it goes up.

The pullback is your second chance to join the buyers if you miss the breakout.

But Pullbacks don’t always occur after every breakout, when it occurs, it represents a great opportunity with a good risk to reward ratio.

What you have to remember is that a ranging market moves horizontally between the support and the resistance level.

These are the key levels that you have to focus on. The breakout of the support or the resistance level indicates that the ranging period is over, so you have to make sure that the breakout is real to join the new trend safely.

If you miss the breakout, wait for the pullback. when it occurs, don’t hesitate to enter the market.

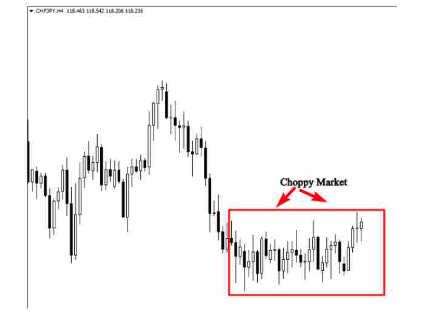

When you are trading ranging markets, always make sure that the market is worth trading, if you feel like you can’t identify the boundaries (support and resistance). this is a clear indication of a choppy market.

In Forex, choppy markets are those which have no clear directions, when you open your chart, and you find a lot of noise, you can’t even decide if the market is ranging, or trending.

You have to know that you are watching a choppy market. This type of markets can make you feel very emotional and doubt your trading strategies as it starts to drop in performance.

The best way to determine if a market is choppy is just by zooming out on the daily chart and taking in the bigger picture.

After some training, screen time and experience, you will easily be able to identify if a market is ranging or it is a choppy market.

Here is a good example of a choppy chart that is not worth trading.

Notice in the chart above, the price action in the highlighted area is very choppy, and it is moving sideways in a very small tight range. This is a sign of a choppy market that you should stay away from.

If a market is choppy, in my opinion, it is not worth trading, if you try to trade it, you will give back your profits shortly after big winners, because markets often consolidate after making big moves.

Itís hard to find knowledgeable people for this subject, however, you seem like you know what youíre talking about! Thanks

דירות דיסקרטיות באילת Todd Stickrod